XRP Price Prediction: Analyzing Investment Potential Amid Market Volatility

#XRP

- Technical Consolidation: XRP trades near moving average with Bollinger Band compression indicating potential breakout direction

- Fundamental Strength: Regulatory clarity, ETF filings, and institutional adoption provide strong foundation

- Risk Considerations: Market volatility and manipulation concerns require careful position management

XRP Price Prediction

Technical Analysis: XRP Shows Mixed Signals Near Key Support

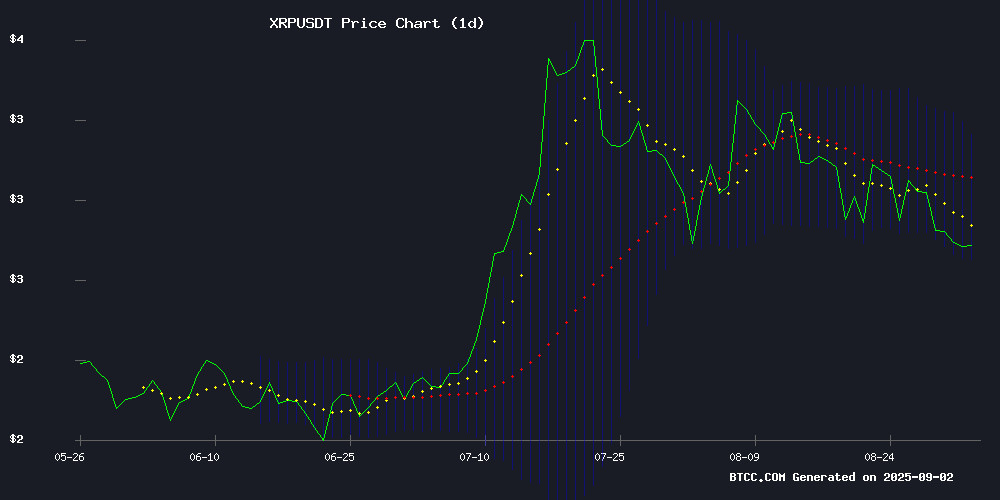

XRP is currently trading at $2.849, slightly below its 20-day moving average of $2.9526, indicating potential short-term weakness. The MACD reading of 0.1286 versus 0.1280 shows minimal momentum divergence, while the Bollinger Bands position suggests the asset is trading NEAR the middle range between $3.1813 (upper) and $2.7239 (lower). According to BTCC financial analyst Mia, 'XRP appears to be consolidating around key technical levels. A break above the 20-day MA could signal renewed bullish momentum, while failure to hold above $2.72 may indicate further downside pressure.'

Market Sentiment: Bullish Fundamentals Amid Technical Consolidation

Recent news FLOW surrounding XRP presents a predominantly optimistic outlook despite current technical consolidation. Positive developments include Gemini AI's $5.05 price forecast, the filing of the first XRP Spot Income ETF, and VivoPower's $30M allocation to Doppler Finance's XRP yield program. BTCC financial analyst Mia notes, 'The fundamental backdrop remains strong with regulatory clarity, institutional adoption, and continued development activity. However, short-term concerns about market manipulation and volatility require careful monitoring. The nine-month streak above $2 demonstrates underlying strength despite recent fluctuations.'

Factors Influencing XRP's Price

XRP Price Faces Downward Pressure as Remittix Gains Traction

XRP's price trajectory appears increasingly bearish, with technical indicators suggesting a potential year-end valuation below $2. The cryptocurrency, once a darling of the remittance sector, now grapples with waning investor confidence as practical alternatives like Remittix emerge.

Market dynamics reveal a troubling pattern: despite legal victories and institutional partnerships, XRP fails to convert these advantages into sustained growth. Whale activity shows signs of rotation, with the token testing critical support levels around $2.80. A breach here could accelerate declines toward $2.50.

Remittix capitalizes on this vulnerability through its PayFi model, attracting XRP holders with tangible utility and a $250,000 promotional giveaway. The challenger's upcoming Q3 wallet beta further compounds competitive pressures, offering what some analysts describe as 'explosive growth potential' absent in XRP's current ecosystem.

XRP Community Buzzes as Influencer Hints at Major Crypto Development

Gordon, a prominent XRP advocate, ignited speculation with a cryptic social media post suggesting an imminent major event in the cryptocurrency space. "Something HUGE is coming. Are you paying attention?" he tweeted, triggering widespread discussion among XRP enthusiasts.

The community response has been polarized. Crypto Crib reinforced Gordon's urgency, stating "We are, that's how we stay ahead of the market," while skeptics dismissed the claim as hype. Market observers note such announcements often precede regulatory developments or partnership revelations in the XRP ecosystem.

Historical patterns show XRP price volatility around similar influencer announcements, though the actual impact varies significantly based on subsequent confirmation. The lack of concrete details has led to tempered expectations among institutional traders.

Gemini AI Forecasts XRP Rally to $5.05 by 2025 Amid Regulatory Clarity

Google's Gemini AI projects XRP could surge to $5.05 by September 30, 2025, as regulatory clarity emerges from Ripple's prolonged SEC lawsuit. The resolution is expected to stabilize the token's valuation, currently trading at $2.77 after recent volatility.

Institutional adoption of Ripple's cross-border payment network may accelerate price appreciation. Market cycle analysis positions XRP in mid-growth phase, with Bitcoin's 2024 halving likely creating secondary bullish momentum.

The SEC case conclusion marks a pivotal inflection point. Regulatory certainty could transform XRP from a speculative asset into a compliant settlement mechanism, attracting institutional capital flows previously deterred by legal uncertainty.

XRP Investment Outlook: 7 Key Factors Post-SEC Legal Clarity

XRP's investment thesis has fundamentally shifted following the resolution of its landmark SEC case in 2024. The $125 million settlement removed existential regulatory risk, reopening institutional pipelines that had been frozen since 2020. Ripple's native token now operates with clearer compliance parameters, evidenced by renewed ETF filings and relistings on major exchanges.

The payment token's utility is gaining traction through RippleNet's On-Demand Liquidity corridors, particularly in Asia-Pacific and Middle Eastern markets. Transaction volume through these channels grew 380% year-over-year as of Q2 2024, though the escrowed 35 billion XRP remains an overhang on price appreciation.

Market dynamics show contradictory signals - while institutional custody solutions have expanded, XRP still exhibits 40% higher volatility than top-tier crypto assets. The impending USDC integration on XRPL in 2025 could further cement its role in cross-border settlements, but competition from CBDC projects looms.

eToro Review 2025: Safety, Legitimacy, and Value in Multi-Asset Trading

eToro remains a dominant force in the multi-asset brokerage space as of 2025, managing over $17.5 billion in assets under administration across 40 million registered users. The platform's unique blend of social trading tools like CopyTrader and Smart Portfolios continues to attract retail investors seeking fractional shares and diverse asset exposure—from stocks and ETFs to cryptocurrencies.

Regulatory compliance remains robust, with FCA oversight in the UK, CySEC licensing in the EU, and SEC registration in the U.S. The platform recently expanded its American crypto offerings, though advanced traders may find its tools lacking for high-frequency strategies.

XRP Maintains Nine-Month Streak Above $2 Despite Market Volatility

XRP has defied broader market downturns by closing above the $2 threshold for nine consecutive months since December 2024. The asset's resilience comes despite a 10% decline over the past four weeks, with prices currently testing support at $2.80.

Community analyst Saul highlights the significance of this performance, noting XRP had never previously sustained monthly closes above $1.99 until November 2024. Historical data from Bitstamp reveals December 2017's $1.99 close followed a record 746.81% monthly surge.

While some investors express bearish sentiment - including crypto influencer Bitlord's threat to liquidate at $2 - the token demonstrates improved fundamentals compared to previous cycles. The achievement appears more striking against a market backdrop where $410 billion has evaporated from total crypto capitalization since last month's peak.

XRP Price Volatility Sparks Investor Concerns Amid Cloud Mining Alternatives

Ripple's XRP has captivated the crypto market with its dramatic price swings, surging to a 52-week high of $3.65 in July before retreating 25% to $2.72. The volatility has left investors questioning whether to anticipate a rebound or seek stability elsewhere.

GMO Miner emerges as a counterpoint to market turbulence, offering cloud mining services promising $6,800 daily earnings for XRP holders. The platform touts instant $15 signup bonuses and a fee-free structure, positioning itself as a hedge against cryptocurrency's inherent unpredictability.

XRP's fundamental value proposition remains intact—its cross-border payment utility continues to anchor long-term prospects. Yet short-term pressures persist, with macroeconomic forces and regulatory uncertainty amplifying price action beyond most retail investors' risk tolerance.

Binance Accused of XRP Market Manipulation Amid Whale Accumulation

Binance faces allegations of artificially suppressing XRP's price through coordinated sell pressure, according to crypto analyst Pumpius. The exchange allegedly employs market makers to drain liquidity following positive XRP developments, creating a perception of negative market reaction.

Whale investors have accumulated 340 million XRP ($962M) over two weeks, signaling strong conviction in an impending breakout. This accumulation contrasts with XRP's 4% weekly decline, highlighting a divergence between institutional interest and short-term price action.

Technical analysts identify $3.20 as a critical resistance level, with a breakout potentially propelling XRP beyond $4. The growing whale activity suggests market participants anticipate this upward movement despite the alleged exchange manipulation.

VivoPower Allocates $30M to Doppler Finance’s XRP Yield Program, Eyes $200M Treasury Deployment

VivoPower International, a NASDAQ-listed company (VVPR), has committed $30 million to Doppler Finance’s XRP yield program, marking the initial phase of a planned $200 million treasury deployment. The strategic move underscores VivoPower’s bullish stance on the XRP Ledger (XRPL) ecosystem and its institutional-grade yield infrastructure.

Doppler Finance’s platform offers segregated accounts and real-time Proof-of-Reserves verification, aligning with VivoPower’s emphasis on transparency and risk management. The partnership targets South Korea’s burgeoning XRP market, with applications spanning cross-border payments, tokenization, and decentralized finance.

The treasury program leverages XRP’s liquidity and settlement efficiency while maintaining qualified custody standards—a calculated approach to digital asset yield generation amid growing institutional interest in blockchain-based treasury management solutions.

Amplify Investments Files for First-Ever XRP Spot Income ETF with SEC

Amplify Investments has submitted a groundbreaking application to the U.S. SEC for an XRP Spot Income ETF. This innovative fund would allow investors to gain exposure to XRP's price movements and earn additional income without directly holding the cryptocurrency. The proposed ETF allocates 80% of its portfolio to XRP-linked derivatives and options, employing a covered call strategy to generate yield.

The filing marks a significant milestone in crypto investment vehicles, particularly for XRP which has faced regulatory uncertainty. Amplify brings substantial credibility to the proposal, with over 70 existing ETFs and $12.6 billion in assets under management. Market observers note this could open XRP exposure to a broader investor base if approved.

Crypto attorney Bill Morgan highlighted the fund's unique structure: "It doesn't require direct XRP custody but tracks value through derivatives." The covered call approach aims to provide both price participation and income generation, potentially appealing to risk-averse investors seeking crypto exposure.

Analyst Outlines Three Factors Supporting Continued XRP Bull Run

XRP's recent price correction to $2.69—its lowest level since July—has sparked concern among some holders, but technical analyst EGRAG argues the bullish structure remains intact. Three technical factors underpin his optimism: monthly candle formations remain unbroken, key Fibonacci support at $1.99 holds, and the asset continues trading above the 21 EMA, a critical momentum indicator.

The analyst maintains that unless these levels break, XRP could still target $3.90, which would mark a new all-time high. This projection aligns with the 1.272 Fibonacci extension level, a common technical target during bullish phases. Market participants now watch whether the recent rebound to $2.80 signals the start of this next leg upward.

Is XRP a good investment?

Based on current technical and fundamental analysis, XRP presents a compelling investment case with measured risk. The asset maintains strong support above $2 while facing resistance near $3.18. Key positive factors include regulatory clarity post-SEC resolution, growing institutional adoption, and innovative financial products like the proposed XRP ETF.

| Metric | Current Value | Signal |

|---|---|---|

| Current Price | $2.849 | Neutral |

| 20-day MA | $2.9526 | Slight Resistance |

| Bollinger Upper | $3.1813 | Key Resistance |

| Bollinger Lower | $2.7239 | Strong Support |

| MACD | 0.0006 | Neutral Momentum |

While short-term volatility may continue, the combination of technical support levels and positive fundamental developments suggests XRP remains a viable investment for those with moderate risk tolerance and a medium to long-term perspective.